Tax Return Work Travel . travel expenses includes information about: in order to calculate the remuneration corresponding to work performed abroad, the days that the worker has actually been. if you have to travel for your work you may be able to claim tax relief on the cost or money you’ve spent on food or overnight. employees who travel for work purposes may be eligible for tax relief on travel expenses that are not reimbursed by their employer. you can't claim trips between your home and place of work, except in limited circumstances. Evidence you need if you wish to claim meal, accommodation and.

from www.interexchange.org

employees who travel for work purposes may be eligible for tax relief on travel expenses that are not reimbursed by their employer. in order to calculate the remuneration corresponding to work performed abroad, the days that the worker has actually been. travel expenses includes information about: Evidence you need if you wish to claim meal, accommodation and. if you have to travel for your work you may be able to claim tax relief on the cost or money you’ve spent on food or overnight. you can't claim trips between your home and place of work, except in limited circumstances.

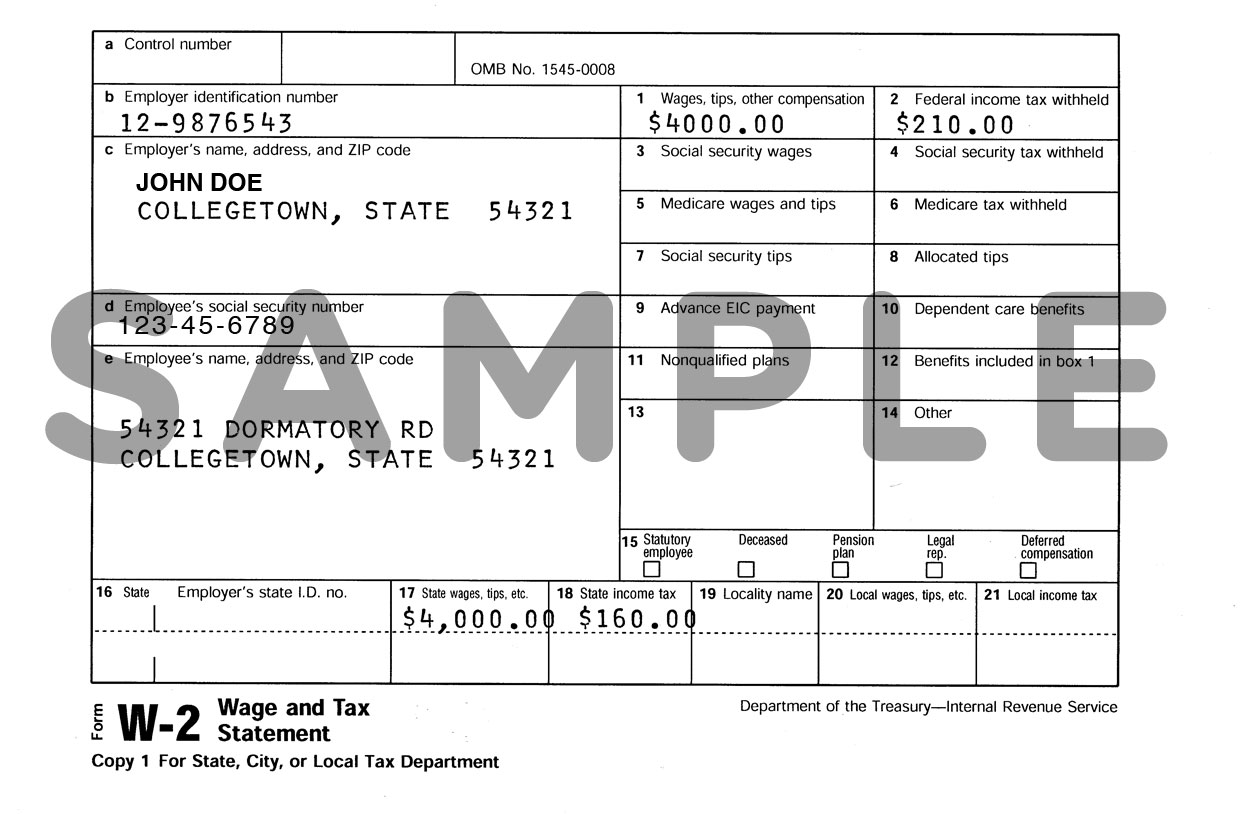

Filing Your Taxes · Work & Travel USA · InterExchange

Tax Return Work Travel employees who travel for work purposes may be eligible for tax relief on travel expenses that are not reimbursed by their employer. you can't claim trips between your home and place of work, except in limited circumstances. travel expenses includes information about: in order to calculate the remuneration corresponding to work performed abroad, the days that the worker has actually been. Evidence you need if you wish to claim meal, accommodation and. if you have to travel for your work you may be able to claim tax relief on the cost or money you’ve spent on food or overnight. employees who travel for work purposes may be eligible for tax relief on travel expenses that are not reimbursed by their employer.

From tieza.gov.ph

NOTICE ON REGULAR TRAVEL TAX REFUND Tourism Infrastructure and Tax Return Work Travel if you have to travel for your work you may be able to claim tax relief on the cost or money you’ve spent on food or overnight. employees who travel for work purposes may be eligible for tax relief on travel expenses that are not reimbursed by their employer. in order to calculate the remuneration corresponding to. Tax Return Work Travel.

From excelsapp.com

Travel Tax Invoice Template Excels App Tax Return Work Travel in order to calculate the remuneration corresponding to work performed abroad, the days that the worker has actually been. Evidence you need if you wish to claim meal, accommodation and. you can't claim trips between your home and place of work, except in limited circumstances. travel expenses includes information about: employees who travel for work purposes. Tax Return Work Travel.

From www.tffn.net

How Does Tax Return Work? A StepbyStep Guide to Filing Your Tax Tax Return Work Travel in order to calculate the remuneration corresponding to work performed abroad, the days that the worker has actually been. Evidence you need if you wish to claim meal, accommodation and. travel expenses includes information about: you can't claim trips between your home and place of work, except in limited circumstances. if you have to travel for. Tax Return Work Travel.

From www.breakinglatest.news

This is how you get your travel expenses back via your tax return Tax Return Work Travel employees who travel for work purposes may be eligible for tax relief on travel expenses that are not reimbursed by their employer. if you have to travel for your work you may be able to claim tax relief on the cost or money you’ve spent on food or overnight. travel expenses includes information about: Evidence you need. Tax Return Work Travel.

From www.teachaway.com

How Do I File a U.S. Tax Return After Teaching Abroad? Ask Teach Away Tax Return Work Travel you can't claim trips between your home and place of work, except in limited circumstances. Evidence you need if you wish to claim meal, accommodation and. in order to calculate the remuneration corresponding to work performed abroad, the days that the worker has actually been. employees who travel for work purposes may be eligible for tax relief. Tax Return Work Travel.

From www.taxpayers.org.nz

Travel Tax Petition Taxpayers' Union Tax Return Work Travel travel expenses includes information about: in order to calculate the remuneration corresponding to work performed abroad, the days that the worker has actually been. employees who travel for work purposes may be eligible for tax relief on travel expenses that are not reimbursed by their employer. Evidence you need if you wish to claim meal, accommodation and.. Tax Return Work Travel.

From www.interexchange.org

Filing Your Taxes · Work & Travel USA · InterExchange Tax Return Work Travel Evidence you need if you wish to claim meal, accommodation and. employees who travel for work purposes may be eligible for tax relief on travel expenses that are not reimbursed by their employer. travel expenses includes information about: you can't claim trips between your home and place of work, except in limited circumstances. in order to. Tax Return Work Travel.

From www.kampungbloggers.com

Tax Returns and How Do They Work Tax Return Work Travel in order to calculate the remuneration corresponding to work performed abroad, the days that the worker has actually been. Evidence you need if you wish to claim meal, accommodation and. travel expenses includes information about: if you have to travel for your work you may be able to claim tax relief on the cost or money you’ve. Tax Return Work Travel.

From quickbooks.intuit.com

Travel expense tax deduction guide How to maximize writeoffs QuickBooks Tax Return Work Travel Evidence you need if you wish to claim meal, accommodation and. travel expenses includes information about: employees who travel for work purposes may be eligible for tax relief on travel expenses that are not reimbursed by their employer. in order to calculate the remuneration corresponding to work performed abroad, the days that the worker has actually been.. Tax Return Work Travel.

From www.scribd.com

Travel Receipt PDF Value Added Tax Euro Tax Return Work Travel employees who travel for work purposes may be eligible for tax relief on travel expenses that are not reimbursed by their employer. travel expenses includes information about: you can't claim trips between your home and place of work, except in limited circumstances. Evidence you need if you wish to claim meal, accommodation and. if you have. Tax Return Work Travel.

From www.philstar.com

You can now pay travel tax online. Here’s how Tax Return Work Travel employees who travel for work purposes may be eligible for tax relief on travel expenses that are not reimbursed by their employer. you can't claim trips between your home and place of work, except in limited circumstances. travel expenses includes information about: if you have to travel for your work you may be able to claim. Tax Return Work Travel.

From 1044form.com

Completing Form 1040 The Face Of Your Tax Return US 2021 Tax Forms Tax Return Work Travel in order to calculate the remuneration corresponding to work performed abroad, the days that the worker has actually been. if you have to travel for your work you may be able to claim tax relief on the cost or money you’ve spent on food or overnight. travel expenses includes information about: you can't claim trips between. Tax Return Work Travel.

From butchixanh.edu.vn

Your Guide to Business Codes for Taxes [Updated for 2023 Tax Return Work Travel travel expenses includes information about: you can't claim trips between your home and place of work, except in limited circumstances. if you have to travel for your work you may be able to claim tax relief on the cost or money you’ve spent on food or overnight. Evidence you need if you wish to claim meal, accommodation. Tax Return Work Travel.

From simpleathome.com

Make your Tax Return Work for you — Simple At Home Tax Return Work Travel you can't claim trips between your home and place of work, except in limited circumstances. travel expenses includes information about: Evidence you need if you wish to claim meal, accommodation and. in order to calculate the remuneration corresponding to work performed abroad, the days that the worker has actually been. if you have to travel for. Tax Return Work Travel.

From www.tffn.net

Exploring How Tax Returns Work A StepByStep Guide The Enlightened Tax Return Work Travel travel expenses includes information about: if you have to travel for your work you may be able to claim tax relief on the cost or money you’ve spent on food or overnight. you can't claim trips between your home and place of work, except in limited circumstances. employees who travel for work purposes may be eligible. Tax Return Work Travel.

From www.tripsavvy.com

Business Travel Tax Deductions Tax Return Work Travel in order to calculate the remuneration corresponding to work performed abroad, the days that the worker has actually been. you can't claim trips between your home and place of work, except in limited circumstances. if you have to travel for your work you may be able to claim tax relief on the cost or money you’ve spent. Tax Return Work Travel.

From thebookkeepingstudio.com.au

How Do Tax Returns Work? The Bookkeeping Studio Tax Return Work Travel employees who travel for work purposes may be eligible for tax relief on travel expenses that are not reimbursed by their employer. in order to calculate the remuneration corresponding to work performed abroad, the days that the worker has actually been. travel expenses includes information about: if you have to travel for your work you may. Tax Return Work Travel.

From www.stkittsvilla.com

Leave Travel Allowance Lta Claim Rule Eligibility Tax Exemptions Tax Return Work Travel in order to calculate the remuneration corresponding to work performed abroad, the days that the worker has actually been. if you have to travel for your work you may be able to claim tax relief on the cost or money you’ve spent on food or overnight. travel expenses includes information about: employees who travel for work. Tax Return Work Travel.